capital gains tax adalah

Perolehan keuntungan dari capital gain adalah selisih harga dari penjualan. Apa Itu Capital Gain.

Djp Online Adalah Cara Termudah Dan Paling Pantas Bagi Wajib Pajak Untuk Membayar Pajak Tepat Waktu Tanpa Perlu Repot Tax Debt Filing Taxes Capital Gains Tax

Other income-related tax rates to keep in mind.

. Istilah ini sering disebut dengan capital gain atau keuntungan modal yaitu keuntungan sebesar-besarnya yang diperoleh dari penjualan aset untuk investasi tertentu seperti saham. Pemerintah baru saja meluncurkan Paket Kebijakan Ekonomi Berkeadilan. 20 based on gross income.

Capital gain adalah jumlah keuntungan seorang investor saat menjual kembali aset investasinya. Capital gains tax cgt is not a separate tax but forms part of. As you can see above Indonesia uses a progressive tax rate.

Berbagai negara di dunia ada yang mengenakan pajak atas capital gains atau yang lebih dikenal dengan capital gains tax dengan mengenakan pajak atas keuntungan nilai aset. Ini merupakan paket kebijakan yang sangat bagus. You pay 0 on long-term capital gains if.

Dilansir dari Economic Times capital gain adalah keuntungan yang diperoleh dari hasil penjualan aset seperti saham obligasi dan properti. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For 2022 the thresholds are slightly higher.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset. Capital Gains Tax was introduced on 1 October 2001. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Dalam bahasa Indonesia arti capital gain disebut juga dengan keuntungan modal. What is Capital Gains Tax. Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines.

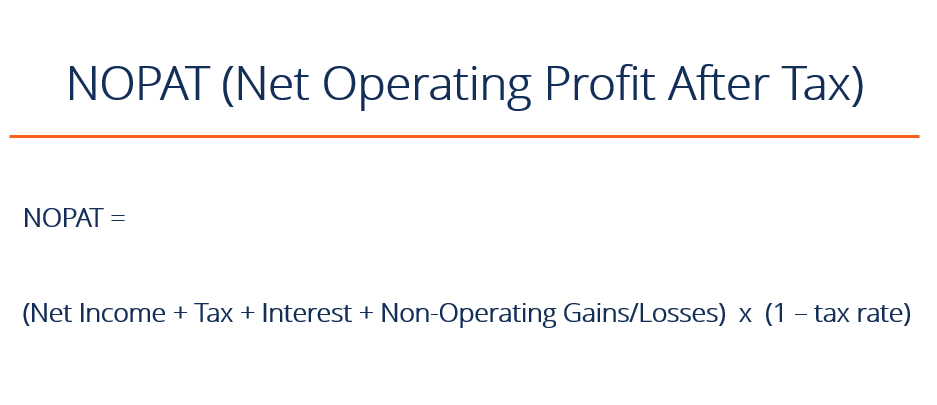

Pajak untuk keuntungan modal capital gain tax yang dikenakan pun akan disesuaikan dengan besaran pajak penghasilan PPh yang biasa dimiliki. Its the gain you make thats taxed not the amount of. It forms part of normal income tax and is based on the sliding tax tables for individuals.

Secara istilah capital gains tax sendiri merupakan pajak yang dikenakan atas keuntungan gains pengalihan aset seperti saham dan properti. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Capital gains tax adalah.

Apa yang dimaksud Capital Gain Tax. Capital gains tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Capital gain adalah keuntungan yang direalisasikan setelah menjual aset jangka panjang sedangkan dividen adalah pendapatan yang diperoleh dari keuntungan perusahaan.

If youre a tax non-resident. PASAL 13 OECD dan UN Model tentang pemajakan atas capital gains merupakan pasal yang mengatur alokasi hak pemajakan di antara dua negara atas keuntungan gains dari. You report capital gains and capital losses in your income tax return and.

Keuntungan ini didapat karena. The rate is 15 if the persons income is 445850 or less and 20 if it is over that amount.

Capital Gains Tax What Is It When Do You Pay It

Top Marginal Tax Rate And Top Capital Gains Tax Rate 1945 2010 Download High Resolution Scientific Diagram

Trading Tax Tips Saving On Taxes Fidelity

What You Need To Know About Capital Gains Tax

Tax Loss Harvesting What Is It And How Does It Work

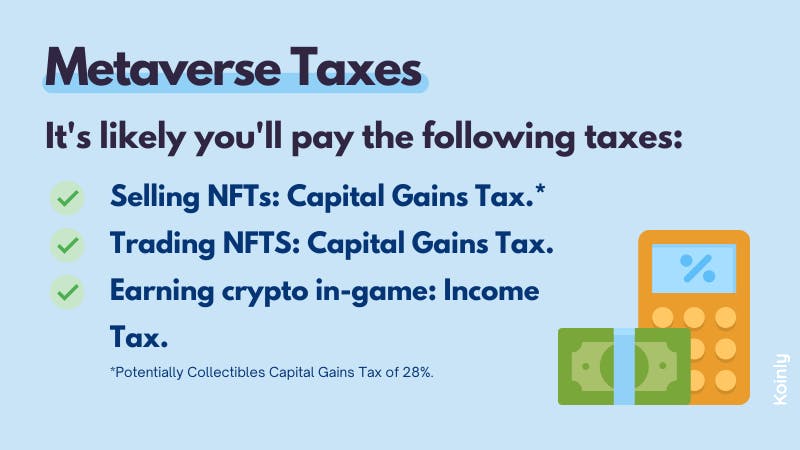

Metaverse Tax How Does It Work Koinly

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

What Are Capital Gains Taxes And How Could They Be Reformed

Raise The 15 Percent Tax Rate On Capital Gains To Boost Revenue In A Progressive Way Tax Policy Center

Capital Gain Adalah Ini Pengertianya

Impact Of Us Plans To Nearly Double Capital Gains Tax Clearly Visible On Stock Markets Industry Global News24

Capital Gains Definition Rules Taxes And Asset Types

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates By State

Solution Investment And Business Taxation Topic 6 Capital Gains Taxation Studypool

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet